For those who always put our children first

A 403(b) can help you enjoy the retirement you imagine

Last year, you showed the world how to rise to the occasion as you continued to invest in our children. This year, make sure to invest in yourself with a 403(b) retirement plan from Equitable. Whether you’re just starting your career as an educator or starting to think about retirement, a 403(b) is a powerful, yet flexible investment tool that can help supplement your pension.How much income will you need?

A 403(b) can be a smart investment for your future

Adding a 403(b) to your retirement plan can help you secure a future you’ll enjoy. Even small savings can go a long way.

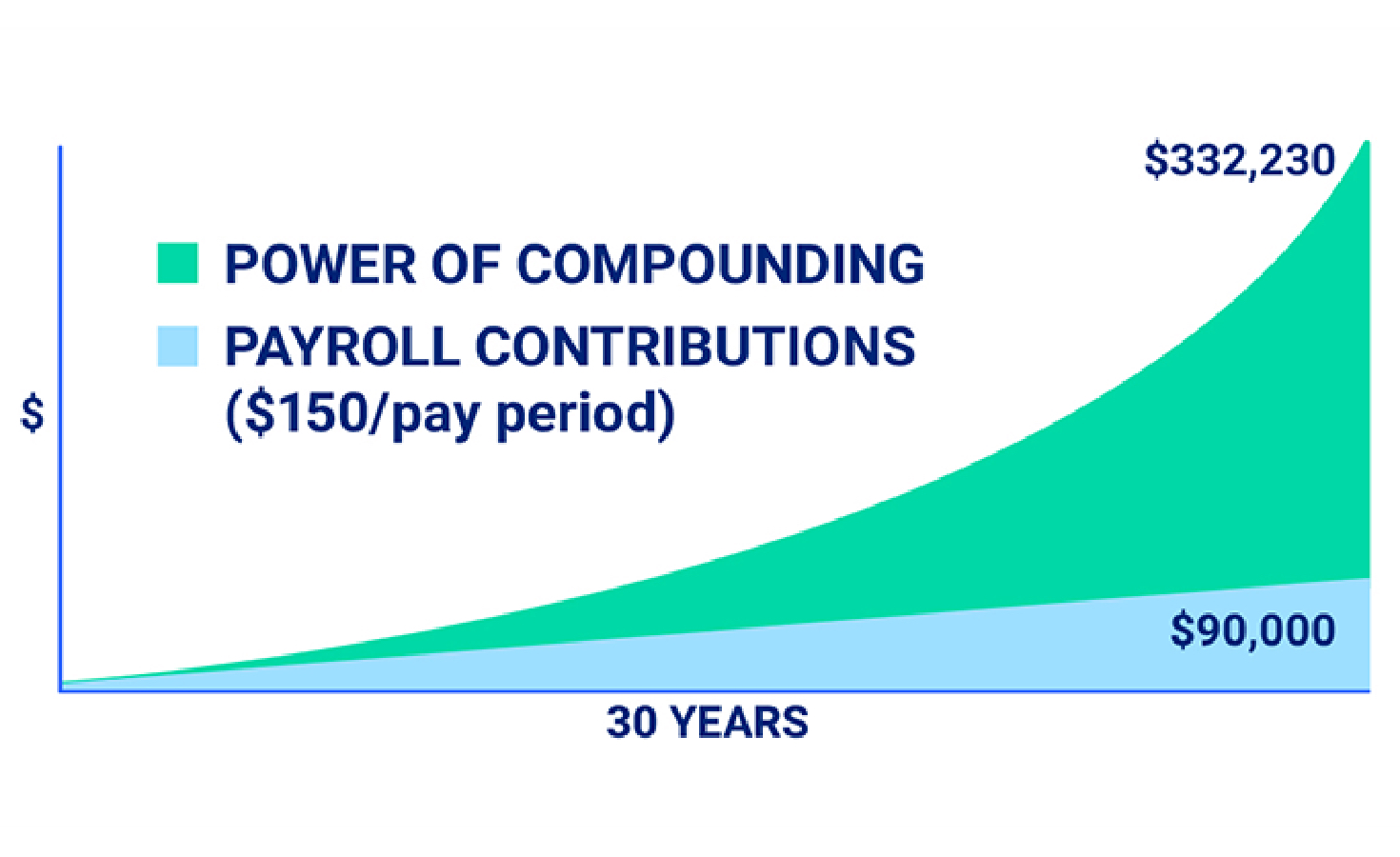

Thanks to the power of compound interest, every dollar you put in has potential to grow – especially if your employer matches a portion of your contributions.

And, if you’re over 50 you have the option to make even higher tax-deferred catch-up contributions.

By putting $150 in pre-tax dollars per pay period into your 403(b), your savings could grow to $332,230 in 30 years.³

Simplify your investments with Semester Strategiessm

Control your retirement with less stress

Need a little help with how to invest? Semester Strategiessm, an optional feature available with Equitable Financial's EQUI-VEST® variable annuity contract, is designed specifically for educators like you. It allows you to select your investment mix based on risk tolerance and number of years until retirement.4

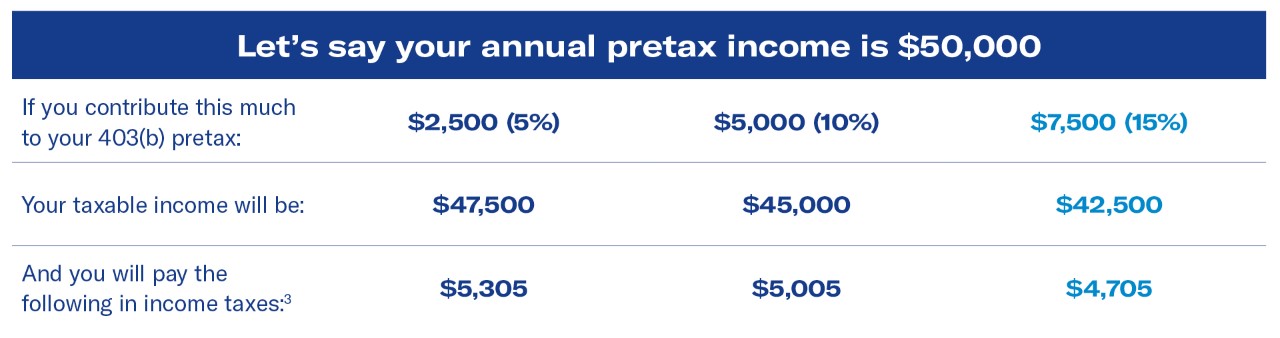

The more you save, the less you could pay in current taxes

Contributions to a 403(b) plan can lower the federal income taxes withheld from your paycheck each pay period and reduce your annual taxable income.

It pays to work with a financial professional

Planning for retirement might seem complicated, but Equitable Financial can make the process easier and more productive. Educators who work with a financial professional save more and are more satisfied with their retirement plans.5

Enroll securely now or talk to a financial professional

Whether you're ready to enroll now or have a few questions first, choose how you want to get started.

1 LIMRA, Not for Profit Survey, Q1 2020 Results, based on 403(b) plan participants and contributions. This applies specifically and exclusive to Equitable Financial Life Insurance Company (Equitable Financial)

2 This assumes a hypothetical 7.5% return and there are no withdrawals. Withdrawals are subject to ordinary income tax and, if made before age 59½, may be subject to an additional 10% federal income tax. This example is for illustrative purposes only and is not intended to represent an expected or guaranteed rate of return for any investment vehicle. This example does not take potential taxes, investment management fees or product-related charges into account. Your rate of return will vary. Amounts are fully taxable upon withdrawal and the accumulation values illustrated will be reduced, based on an individual’s tax rate

3 Based on 2021 federal tax tables, assuming married filing jointly (source: www.irs.gov). Figures do not take into account any other sources of income, state or local income taxes, tax credits or deductions.

4 If available under the employer's plan, EQUI-VEST® variable annuity contract holders may generally enroll in the model portfolio and investment advisory services program (the “Program”, i.e., Semester Strategiessm) of SWBC Investment Advisory Services LLC (“SWBC”) to allocate your account value among the variable investment options, based on your set time horizon, risk tolerance and investment return objectives derived by SWBC from information you provide to SWBC. SWBC Retirement Plan Services is an unaffiliated third-party and is a wholly-owned subsidiary of SWBC, which was established in 1976. Advisory services are offered by SWBC Investment Advisory Services, LLC, d/b/a SWBC Retirement Plan Services, a Registered Investment Advisor with the Securities and Exchange Commission. Equitable Financial has entered into an agreement to make SWBC Retirement Plan Services' fiduciary services available to EQUI-VEST® clients through Semester Strategiessm. Click the "Learn more" button above to visit our Semester Strategiessm page on www.equitable.com for more important information.

EQUI-VEST® is a variable deferred annuity designed for retirement purposes. In essence, it is a contractual agreement in which payments are made to an insurance company, which agrees to pay an income stream or lump-sum amount at a later date. There are contract limitations, fees and charges associated with variable deferred annuities, which include, but are not limited to, mortality and expense risk charges, withdrawal charges and administrative fees. For costs and complete details, see the prospectus or contact your financial professional. The variable investment options offered in this contract will fluctuate and are subject to market risk, including loss of principal. EQUI-VEST® is issued by Equitable Financial Life Insurance Company, NY, NY 10104. Equitable Advisors Financial Professionals offer securities through AXA Advisors, LLC (NY, NY, 212-314-4600), member FINRA, SIPC (Equitable Financial Advisors in MI and TN), and offer annuity and insurance products through Equitable Network, LLC (Equitable Network Insurance Agency of California, LLC; Equitable Network Insurance Agency of Utah, LLC; Equitable Network of Puerto Rico, Inc.)

5 Equitable, “The value of the advisor: The Impact of advisors on financial outcomes among K-12 educators.” 2020