Indexed Universal Life insurance

With Indexed Universal Life (IUL), you can live more for today with financial security for life’s unknowns, keep more of the money you earn with potential tax-deferred growth and access to cash value through tax-free loans and withdrawals, and build more for tomorrow with a growth component that compliments the protection your policy provides.

Indexed Universal Life is a type of life insurance that insures one person and pays a benefit to the beneficiary you select after the insured passes away. IUL has the potential to build cash value by allowing you to track a major market index through indexed-linked options.

What is Indexed?

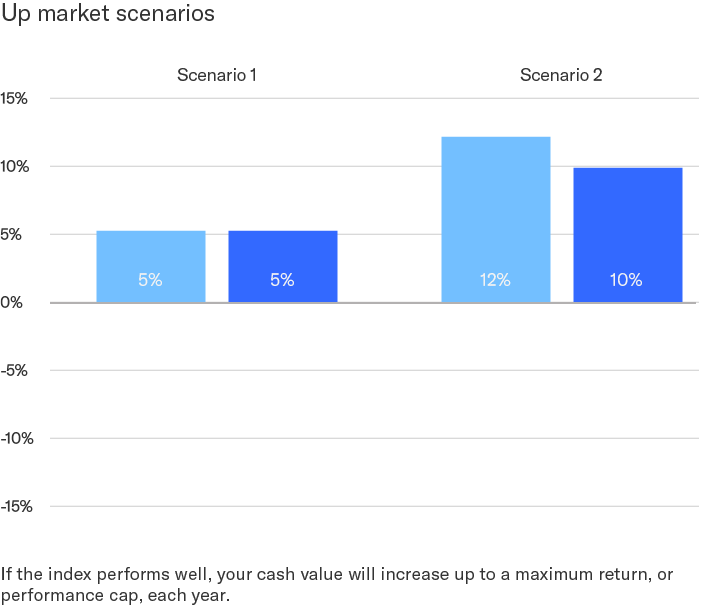

Refers to your ability to invest in an indexed-linked option that gives you the potential to accumulate cash value within your policy based on the performance of an index up to a cap.

What is Universal?

Means you have flexibility in making payments. Your payments and the timing of those payments, can vary from nothing to a maximum amount.1

Tax-Benefits of Life Insurance:

How does IUL work?

When you make a payment to your Indexed Universal Life policy, a portion of that payment goes toward the life insurance benefit that protects your family when you’re no longer around. The other portion has the potential to build cash value by tracking the performance of the S&P 500®Index.

You can access your cash value, tax-free, for important financial goals, help maintain your quality of life in retirement, or take care of emergency expenses.2

Learn more about our Indexed Universal Life policies:

BrightLife® Grow

If you need life insurance and want the potential to build cash value, but feel cautious about the uncertainty of economic conditions, BrightLife® Grow may be a good strategy for you.

Benefits

Designed for accumulation

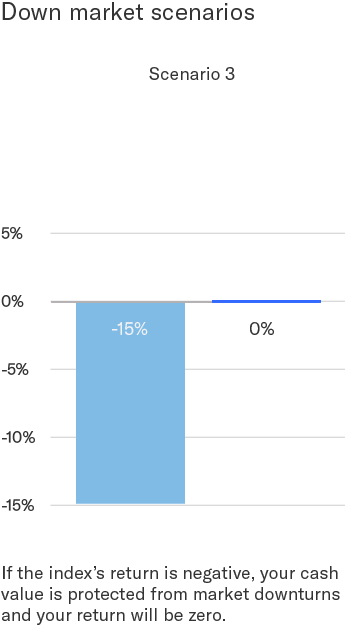

Downside protection

Flexible premiums

All ratings and reviews are voluntarily submitted by existing customers and are pre-screened for acceptance or rejection prior to publication in accordance with established Moderation Guidelines, which consider applicable regulatory parameters for retail communications (i.e., advertising and sales literature) and company standards for appropriate content. Customers' ratings and reviews reflect individual opinions and are not intended as indications of suitability or as predictions of any product/investment performance, may not represent the experience of any other customer, and should not be relied upon as bases for any purchase decision. NOTE: On June 15, 2020, AXA Equitable Life Insurance Company became Equitable Financial Life Insurance Company. Any reviews herein containing “AXA” in any form should be considered to mean “Equitable”. Equitable is the brand name of the retirement and protection subsidiaries of Equitable Holdings, Inc. Equitable Financial Life Insurance Company (Equitable Financial) and its affiliates do not guarantee the accuracy or applicability of the information included in any customer review. Ratings and Reviews are powered by Bazaarvoice, a 3rd party vendor not affiliated with Equitable Financial or its affiliates. For questions or concerns about the ratings and reviews presented here, please call 800-628-6673.

1 Your policy’s cash value must be sufficient to cover your monthly charges. Indexed universal life insurance as used here refers to policies that have not been registered with U.S Securities and Exchange Commission.

2 Under current federal tax rules, you may access your cash surrender value by taking federal income tax-free loans or withdrawals from a life insurance policy that is not a Modified Endowment Contract (MEC) of up to your basis (total premiums paid) in the policy. Certain exceptions may apply for partial withdrawals during the policy’s first 15 years. If the policy is a MEC, all withdrawals or loans are taxed as ordinary income to the extent of gain in the policy, and may also be subject to an additional 10% premature distribution penalty if taken prior to age 59½, unless certain exceptions apply. Loans and partial withdrawals will decrease the death benefit and cash surrender value of your life insurance policy and may be subject to policy limitations and income tax. In addition, loans and partial withdrawals may cause the policy benefits and riders to become unavailable and may increase the chance your policy may lapse. If the policy lapses, is surrendered or becomes a MEC, the loan balance at the time would generally be viewed as a distribution and therefore taxable under the general rules for distribution of policy cash values.

BrightLife® Grow is issued in New York and Puerto Rico by Equitable Financial Life Insurance Company and in all other jurisdictions by Equitable Financial Life Insurance Company of America (Equitable America), an Arizona stock corporation with its main administration office in Jersey City, NJ and are co-distributed by Equitable Distributors, LLC and Equitable Network, LLC (Equitable Network Insurance Agency of California in CA; Equitable Network Insurance Agency of Utah in UT; Equitable Network of Puerto Rico, Inc. in PR), 1290 Avenue of the Americas, New York, NY 10104.

This is a very general description of the BrightLife® Grow product. For costs and more complete details, please contact your financial professional.

BrightLife® Grow is a flexible premium universal life insurance policy with index-linked interest options. Life insurance is subject to exclusions and limitations and terms for keeping it in force, Certain types of policies, features and benefits may not be available in all jurisdictions or may be different.

BrightLife® Grow is issued in New York and Puerto Rico by Equitable Financial Life Insurance Company (Equitable Financial), NY, NY and in all other jurisdictions by Equitable Financial Life Insurance Company of America (Equitable America) (AZ stock company, administrative office: Jersey City NJ). Co-distributed by affiliates Equitable Network LLC (Equitable Network Insurance Agency of California, LLC, in CA; Equitable Network Insurance Agency of Utah, LLC in Utah; Equitable Network of Puerto Rico in PR) and Equitable Distributors, LLC. Equitable Financial, Equitable America, Equitable Network and Equitable Distributors are affiliated companies and do not provide tax or legal advice. Clients should seek the advice of their own tax and legal advisors regarding their individual circumstances.

All guarantees and contractual obligations are based solely on the claims-paying ability of the issuing life insurance company.

Policy form #ICC15-300 or state variations.

BrightLife® is a registered service mark of Equitable Financial Life Insurance Company.