Putting certainty into your future financial well-being

Helping you achieve your goals and build a tomorrow that’s worth looking forward to.

Starting out

Retirement may seem far away, especially when you’re setting out on your own and starting to figure out life. But it’s never too early to dream about your future, and it’s never too early to start saving.

Juggling midlife

There's a lot you've accomplished - and likely so much more you want to do. And then there are realities of your busy day-to-day. You deserve a moment to step back and take stock of your retirement plans as you build toward your future.

Your next chapter

Whether you’re a few years away or counting the days, thinking about retirement is exciting. Knowing how your savings will support your passions, your health and your family is the peace of mind you’ve earned.

Not working with a financial professional?

Request to have an Equitable Advisors Financial Professional contact you.

Or, Find a professional near you.

If you have an existing account and need support please visit our support section.

Are you an educator?

A career devoted to helping others reach their full potential creates unique needs. Find strategies tailor made for education professionals.

Do you have a retirement plan through work?

Evaluate your retirement income potential using the calculator. Make adjustments and add in other savings to see how changes affect your goals.

Dive in! Your future-self thanks you.

Seeing how people of similar ages and incomes are saving can be inspirational. No matter where you are today, everyone starts somewhere.

Determining peer comparison group

The peer benchmarks displayed were developed in partnership with the Employee Benefit Research Institute (EBRI). The benchmarks were created by analyzing the account balances and contribution levels from EBRI’s Retirement Security Projection Model that draws information from a data set of 24.9 million 401k participants as of December 31st, 2014. A participant’s peer segment is selected based on their age and nearest salary, which is broken down into $5,000 increments. Participants who are earning $20,000 or less are considered to be in the same salary segment.

Working with an advisor* yields more money, more confidence

Higher account balances. More confidence for the future. A common trait among top savers is that they get help from a financial professional to guide smart choices and keep their plan on track as life evolves.

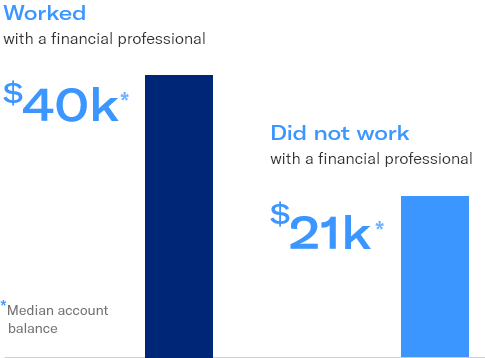

Higher balances

Nearly twice the median account balance was achieved when individuals chose to work with a financial professional

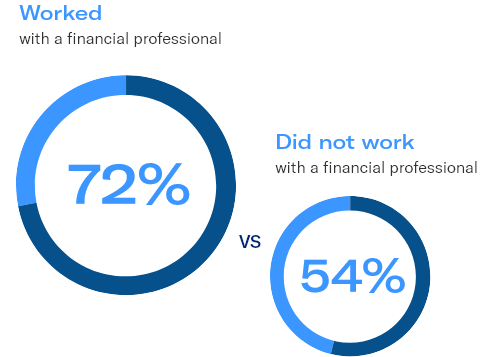

Happier with savings

18% higher satisfaction with their retirement plan when working with a financial professional

Financial professionals also help clients with...

Find more education and research on the benefits of working with a financial professional in our Enhancing Outcomes whitepaper.

Click here to read the full study.

Source: Equitable's Value of the Advisor study, 2018.

Strategies for you

See how we can help meet your individual financial goals - tips, tools, advice and product information.

Workplace retirement plans

Workplace retirement savings plans can be a smart and effective way to build wealth now that may be your income in retirement.

Learn more about planning for retirement

Find out how the SECURE Act is changing retirement and how it could affect you

Access key topics and useful articles about retirement planning

*The use of the terms of “financial advisor” or “advisor” for purposes of the survey questions and responses by both the consumers and the financial advisors queried does not necessarily imply that the individual is a registered investment adviser (RIA). The use of these two terms is meant in a general sense of the word or phrase to describe working with an investment advisor, a licensed insurance agent or other financial professionals who may sell annuity products.