The Secure Act

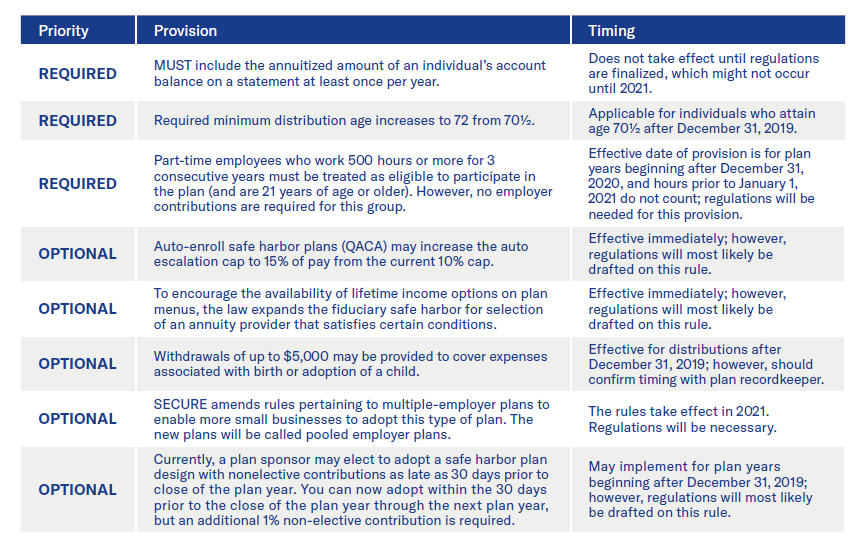

The Setting Every Community Up for Retirement Enhancement (SECURE) Act was signed into law on December 20, 2019. SECURE contains nearly 30 provisions that will have a direct impact on retirement plans. The following summary highlights key provisions and timing.

SECURE Act participant flyer

PLEASE NOTE: SECURE includes a significant increase in penalties for failure to provide notice of withholding election 8955-SSA, and timely file Form 5500, effective for notices and filings after December 31, 2019.

Remedial amendment language in the SECURE Act likely means that plan documents will not have to be amended until the end of the 2022 plan year. However, plan operations must reflect the new mandatory provisions in accordance with the effective date(s).

Please be advised that this document is not intended as legal or tax advice. Accordingly, any tax information provided in this document is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transaction(s) or matter(s) addressed, and you should seek advice based on your particular circumstances from an independent tax advisor.

Material prepared by the American Retirement Association, an organization not affiliate.