Market volatility

Stock market volatility can leave you feeling unsettled. These periods of uncertainty may be uncomfortable, even for the most seasoned investors, but it’s important to keep perspective while pursuing your long-term financial goals.

At Equitable, we’re here to help you navigate through volatility so you can make smart choices based on your needs, not on the market's ups and downs.

Things to remember when it comes to market volatility

What is market volatility?

When investments move up and down (and back again), that is volatility.

More specifically, it’s a measure of how consistently or inconsistently an investment or index has performed compared with either a benchmark or its own historical average.

We can talk about volatility of a single investment, like a stock, or an entire market. One important thing to know about volatility is that it’s a totally normal part of investing.

What is market volatility?

When investments move up and down (and back again), that is volatility. More specifically, it’s a measure of how consistently or inconsistently an investment or index has performed compared with either a benchmark or its own historical average.

We can talk about volatility of a single investment, like a stock, or an entire market. One important thing to know about volatility is that it’s a totally normal part of investing.

How to stay calm

Nearly half of investors say market volatility makes their lives stressful. Learn how to keep emotion out of the equation with these three points.History in perspective

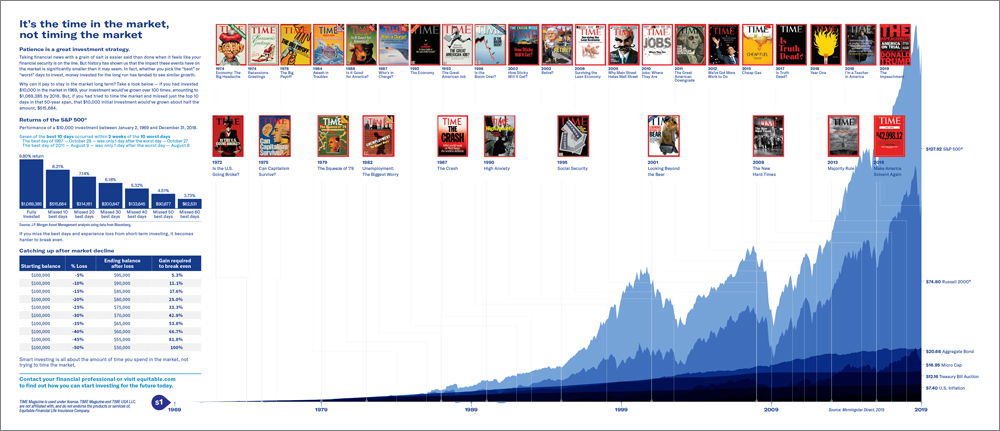

It's the time in the market, not timing the market that matters. See how time has affected investors historically in this brochure.

Past market behavior and investment performance does not guarantee similar or comparable future outcomes or performance. It is not possible to invest directly in an index. Investing involves risk, including loss of principal invested.