How your employer can help you grow your retirement savings

As an incentive to get more employees to save for retirement, many employers contribute money to employees’ retirement account by matching a portion of each employee’s contribution. Matching contributions can be a set amount or a percentage of the amount the employee contributes.

If your employer offers matching contributions, and you’re not taking advantage of them, you’re missing out on extra money that could help you live more comfortably down the road. It doesn’t come at any cost to you, and for those who are already contributing to their retirement plan, it’s just like getting a bonus.

For example, let’s say your employer offers a 50% match, up to 6%. That means, for every 1% of your pay (up to 6%) that you contribute to your plan, your employer will add another .5%. So, if you contribute $200, your employer would contribute another $100.

Since matching contributions are essentially “free money,” consider saving at least the minimum amount to receive the full match. Under current law, any matching contributions are not included in your taxable income until you withdraw them.

This chart illustrates what happens when your employer matches your retirement plan contributions. In this hypothetical example, your employer’s match is 50% of your contribution. Different rates of matching would produce different results.

How much of the matching contributions are yours to keep?

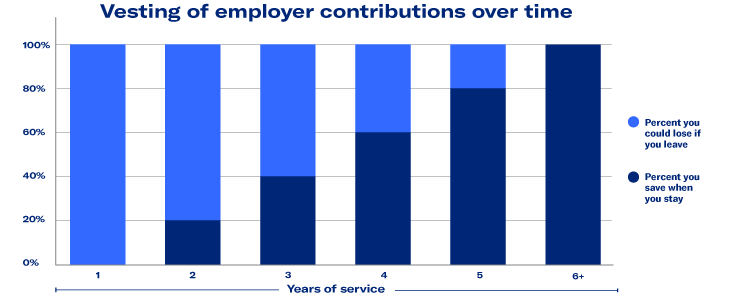

In some plans, a matching contribution is yours to keep as soon as it is placed in your account. However, many employers require you to stay on the job for a specified time. In that case, they’ll have what’s called a vesting period, which will show you how much of the employer contributions are yours to keep, depending on how long you’ve been with the company.

There are two kinds of vesting: vesting and graded vesting.

If your plan uses a cliff vesting schedule, you’d take full ownership of all employer contributions after the specified number of years of service, but if you leave your employer before then, you would not receive any of the matching contributions. IRS rules state that cliff vesting has to occur when an employee completes three years of service (or sooner).

If your plan uses a graded vesting schedule, you’d take ownership of the employer contributions gradually over time, receiving a certain portion each year until you reached 100%. Here’s an example of how it may work.

This chart illustrates the impact of a hypothetical two-year to six-year graded vesting schedule. Your plan may follow a different vesting schedule.

Other important points to keep in mind:

- Match rates

These can vary from plan to plan. Ask your employer how the match rate is structured in your plan. - Roth accounts

An employer can match contributions to a Roth style account, but the matching contributions must be placed in a separate pre-tax (that is, traditional – not Roth) account. - Minimum qualifications

Many employers have a minimum work requirement (such as 1,000 hours over the course of the year) to qualify for employer contributions.

Remember, the contributions you make from your own paycheck are always yours to keep.

Important Note: Equitable believes that education is a key step toward addressing your financial goals, and we’ve designed this material to serve simply as an informational and educational resource. Accordingly, this article does not offer or constitute investment advice and makes no direct or indirect recommendation of any particular product or of the appropriateness of any particular investment-related option. Investing involves risk, including loss of principal invested. Your needs, goals and circumstances are unique, and they require the individualized attention of your financial professional. But for now, take some time just to learn more.

This article is provided for your informational purposes only. Please be advised that this document is not intended as legal or tax advice. Accordingly, any tax information provided in this document is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transaction(s) or matter(s) addressed and you should seek advice based on your particular circumstances from an independent tax advisor.

Equitable Financial Life Insurance Company (New York, NY) issues life insurance and annuity products. Securities offered through Equitable Advisors, LLC, member FINRA, SIPC. Equitable Financial Life Insurance Company and Equitable Advisors are affiliated and do not provide tax or legal advice.