Investment Edge® Variable Annuity

Features and benefits

Not working with a financial professional? Contact us

Call: 1 (855) 830-7140

Monday 9:00 AM–8:00 PM ET Tuesday–Friday 8:00 AM–8:00 PM ET

Or, request to have an Equitable Advisors Financial Professional contact you.

Income Edge – The Differentiator

When you’re ready to start receiving income payments in retirement, Income Edge offers flexibility to optimize how and when you receive distributions — including the option to pay less tax in the early years of retirement when you may be more likely to need it. And Income Edge extends the same benefits to beneficiaries and pre-retirees, too.

Typical annuity withdrawal payments1

Get hit hardest by taxes in the early years of payments.

Income Edge: a tax-efficient approach

Distributes taxes evenly over the course of receiving payments.

Dark blue color above = fully taxable (earnings)

Light blue color above = tax-free (cost basis)

More reasons to research Investment Edge®

Access well-known investment managers

Choose from more than 100 investment options from well-known money managers, ranging from core investments, including U.S. and international equity options, to alternative investments2, which are low-correlated options that can provide further opportunities for diversification and risk-adjusted return.

The list above may not include all investment managers.

2 Alternative investments typically perform differently than traditional asset classes under the same market conditions. Alternative investments can be less liquid and more volatile than traditional investments and often lack longer track records. Alternative funds use investment strategies that differ from the buy and hold strategy typical in the mutual fund industry. Compared to a traditional mutual fund, an alternative fund typically holds more aggressive non-traditional investments and employs more complex trading strategies. Investors considering alternative funds should be aware of their unique characteristics and risks as described in the prospectus before investing. Correlation is a statistical measure of how two investments move in relation to each other. Low correlation suggests that two investments are less likely to move to the same direction in terms of performance.

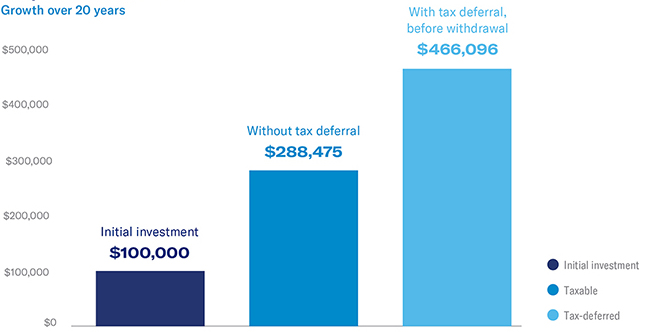

Gain the potential for greater wealth through tax deferral

In the end, it’s not just about what assets you accumulated but also what assets you kept. That’s why Investment Edge®offers tax-deferred growth potential.

During the years when accumulating assets is the goal, tax deferral enables assets to potentially grow more quickly, keeping more money invested. Taxes are paid when withdrawals are taken (see our tax deferral calculators).

The chart below is a hypothetical illustration of the potential advantages of tax-deferred over taxable investments over time. The illustration assumes an annual return of 8% (not guaranteed) and a federal tax rate of 32%.

This hypothetical chart does not represent actual performance of any specific product or investment. Withdrawals of tax-deferred earnings are subject to ordinary income tax treatment. A 10% federal tax may also apply if you take the withdrawal before you reach age 591/2.

Rebalance regularly to stay on track

Over time, investment gains and losses mean investor's portfolios can change from their original asset allocation. Investment Edge® enables investors to rebalance regularly – without costs, taxes or tax paperwork –investor's portfolios can stay on track even when the markets don’t, and potentially boost growth.

All ratings and reviews are voluntarily submitted by existing customers and are pre-screened for acceptance or rejection prior to publication in accordance with established Moderation Guidelines, which consider applicable regulatory parameters for retail communications (i.e., advertising and sales literature) and company standards for appropriate content. Customers' ratings and reviews reflect individual opinions and are not intended as indications of suitability or as predictions of any product/investment performance, may not represent the experience of any other customer, and should not be relied upon as bases for any purchase decision. NOTE: On June 15, 2020, AXA Equitable Life Insurance Company became Equitable Financial Life Insurance Company. Any reviews herein containing “AXA” in any form should be considered to mean “Equitable”. Equitable is the brand name of the retirement and protection subsidiaries of Equitable Holdings, Inc. Equitable Financial Life Insurance Company (Equitable Financial) and its affiliates do not guarantee the accuracy or applicability of the information included in any customer review. Ratings and Reviews are powered by Bazaarvoice, a 3rd party vendor not affiliated with Equitable Financial or its affiliates. For questions or concerns about the ratings and reviews presented here, please call 800-628-6673.

The Investment Edge®variable annuity is a tax-deferred financial product designed to allow you to invest for growth potential and provide income for retirement or other long-term life goals. In essence, annuities are contractual agreements in which payment(s) are made to an insurance company, which agrees to pay out an income or a lump sum amount at a later date. Amounts invested in annuity portfolios are subject to fluctuation and market risk, including loss of principal. There are fees and charges associated with a variable annuity contract, which include, but are not limited to, operations charges, sales and withdrawal charges and administrative fees. The withdrawal charge declines from 6% to 3% over five years for Investment Edge® Series B. Earnings are taxable as ordinary income when distributed and may be subject to an additional 10% federal tax if withdrawn before age 59½.

Investment Edge®offers Income Edge, a feature that allows you to take income on a more tax efficient basis. Income Edge is available for no additional fee and allows investors in non-qualified contracts to elect a customized payment program. When elected, Income Edge is designed to pay out the entire account value via scheduled payments over a set period of time and a portion of each payment is a return of your cost basis and thus excludable from taxes.

This tax-free amount is calculated by dividing the remaining cost basis by the number of years in the payment period selected and will not change once calculated. After Income Edge election, withdrawals are fully taxable, and withdrawals in excess of the annual 10% free withdrawal amount will continue to be subject to a withdrawal charge if they are made during the withdrawal charge period. If the contract owner dies after Income Edge is elected, scheduled payments will continue to the beneficiary and any specified form of death benefit payout that you have selected will be invalidated. The Income Edge payment program does not represent a life contingent annualization of the Investment Edge® contract. With a life contingent annuitization the account value is applied to provide periodic payments for life and the Investment Edge® contract and all its benefits terminate. A combination of adverse investment performance, additional withdrawals, and contract fees may reduce the payout period selected. The amount of payments available through the Income Edge program is re-determined on an annual basis, meaning that the amount of the payment may vary each year of the payout period.

Once you begin taking payments, you may not stop the payments. You can take additional withdrawals, subject to ordinary income tax, and the contract can be fully redeemed for the then current account value net of applicable withdrawal charges. There are additional restrictions and limitations including age restrictions and the payout period being limited to specific time periods. Please see the prospectus for more information including Investment Edge® fees and charges.

If you are purchasing an annuity contract to fund an Individual Retirement Annuity (IRA) or employer-sponsored retirement plan, you should be aware that such annuities do no provide tax-deferral benefits beyond those already provided by the Internal Revenue Code. Before purchasing one of these annuities, you should consider whether its features and benefits beyond tax deferral meet your needs and goals. You may also want to consider the relative features, benefits and costs of these annuities with any other investment that you may use in connection with your retirement plan or arrangement. This content is not a complete description of all material provisions of the variable annuity contract. There are certain contract limitations and restrictions associated with an Investment Edge®contract. For costs and complete details of coverage, speak to your financial professional/insurance licensed registered representative. Certain types of contracts, features and benefits may not be available in all jurisdictions. Equitable Financial offers other variable annuity contracts with different fees, charges and features.

Not every contract is available through the same selling broker/dealer. This is not a complete description of Investment Edge®. Annuities are subject to certain restrictions and limitations. For costs and complete details, contact a financial professional. This content was prepared to support the promotion and marketing of Equitable Financial Life Insurance Company variable annuities. Equitable Financial Life Insurance Company, its distributors and their respective representatives do not provide tax, accounting or legal advice. Any tax statements contained herein were not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state or local tax penalties. Please consult your own independent advisors as to any tax, accounting or legal statements made herein.

Investment Edge® is issued by Equitable Financial Life Insurance Company (Equitable Financial), New York, NY 10104.

Co-distributed by affiliates Equitable Advisors, LLC (member FINRA, SIPC) (Equitable Financial Advisors in MI & TN) and Equitable Distributors, LLC.

Contract form #s: 2021BASE1-A, 2021BASE2-A, 2021BASE1-B, 2021BASE2-B and any state variations.