Working with us

Whether you need help with new business, underwriting guidelines or more complicated case design, we’re here to help.

When you work with Equitable, you’ll find that we go out of our way to deserve your business. That means, we offer extra assistance when you have new business to submit, and our underwriting department provides quick turnaround times, a smooth path to competitive offers and the proactive communication you need to stay on top of your cases.

New Business

-

About New Business

How we're different

New Business creates partnerships with Equitable Advisors and Independent partners to provide financial security for our clients and their families. We have a unified team that is committed to helping you grow your life insurance business. Our team includes the following areas: Sales, Underwriting, New Business, Licensing, Commissions, Advanced Markets, Marketing and Communications, and Operations — all working together to help you succeed.

Our goal: Get your case issued quickly and efficiently

This is where your Relationship Case Manager (RCM) comes in.

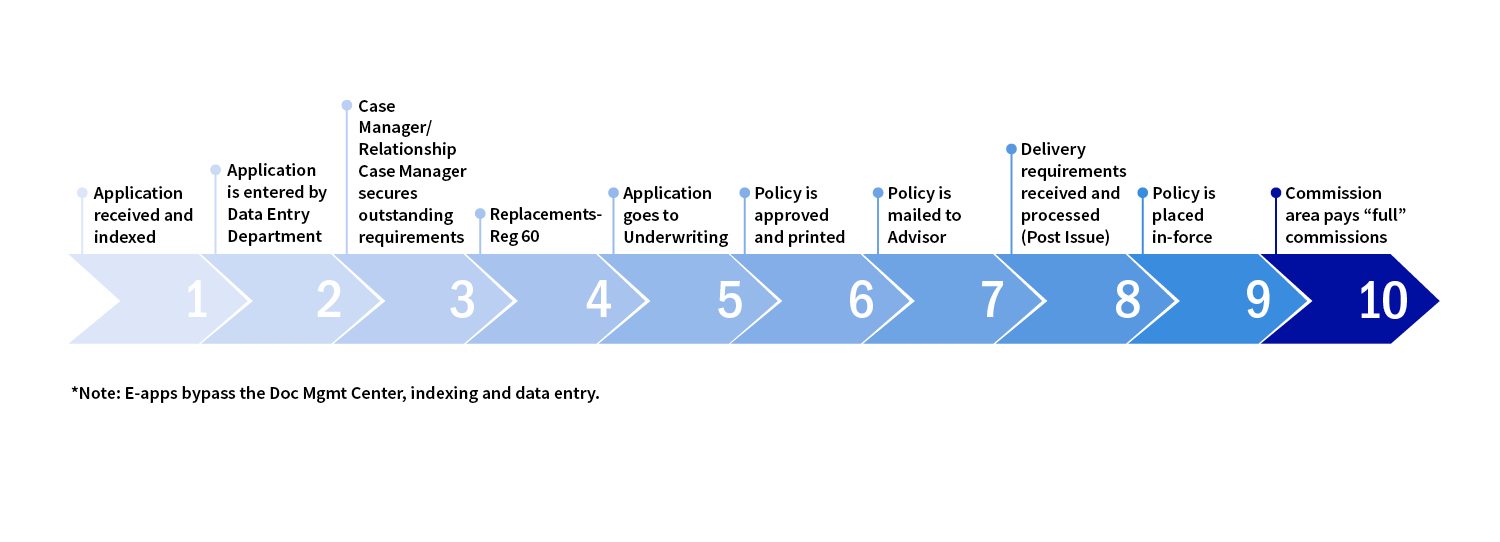

- Your RCM’s job is to shepherd your case through the stages of the process — from submission to commission.

- We encourage you to build a strong relationship with your RCM, because open communication will help them do their job better, which helps you get your case through quickly.

Contact us

We're here to assist with your New Business needs. If you need to reach out to us, please use our interactive contact map.

-

Licensing and appointments

As an agent or registered representative, you must be licensed in every state in which business is transacted with Equitable (both the application state and the owner resident state, if they are different).

Independent Channel

If you are not appointed with Equitable yet, we strongly recommend that you do so before soliciting business.

- Submit appointment paperwork before the application is signed.

- Send all appointment paperwork to your Brokerage General Agency for approval; they will send the completed paperwork to Equitable.

- Find forms and paperwork by visiting equitable.com/log-in, log in and following the path New Business>Licensing>Appointment Forms

Equitable Advisors

Equitable Advisors must be licensed in a state before they can solicit business in that state. Please contact you branch manager for details.

-

Service level agreements

Time frames:

Licensing 24 - 48 hours New Application Processing 24 - 48 hours Underwriting New Business review 24 hours Underwriting subsequent mail review 72 hours Case Manager review and response 24 hours Underwriting last requirement review 24 hours Policy issue 48 hours -

Life of an application

-

Attending Physician's Statement (APS)

Attending Physician’s Statement (APS) play an important role in helping us assess the risk of a proposed insured. They are also one of the most time-consuming parts of the Underwriting process. Here are a few ways that you can help us shorten the timeframe so that we can get you a competitive offer in an efficient manner.

- Complete the Medical Supplement with the Application. If the Underwriter decides an APS is necessary, he or she will order it within 3-5 business days from application receipt. If the Medical Supplement is not included with the application, we cannot order the APS until the exam is received, which could take another 14 days.

- Encourage the client to contact their doctor’s office to release the APS. This can sometimes help to expediate the process.

Typically, here’s what happens:

- Underwriting orders the APS via an Equitable-approved vendor (3-5 days)

- Vendor initiates APS request with doctor or facility within 24 hours

- Vendor follows up with facility every 5 days

- Case Managers proactively follow up with APS vendor for status every 4 business days

- If Special Authorization is needed, case manager will advise agent immediately

- After 14 days, case manager will request that agent contact client to assist with records release to vendor

- Once Underwriting receives the APS from vendor, they match it with the case and review the APS within 3 business days.

-

Submitting an application

Best practices

For faster service, submit your client’s application “in good order.”

Transmittal forms

When submitting a new application please be sure to include the New Business Transmittal Form.

Important addresses, emails, and fax numbers

All New Business paperwork:

Equitable

PO Box 1047

Charlotte, NC 28201Overnight Mail:

Equitable

8501 IBM Drive, Suite 150

Charlotte, NC 28262-4333

Paperwork Fax:

(855) 266-6819

Informals

EquitableInformal@equitable.comFormals

EquitableFormal@equitable.comTerm Conversions

noctermconversion@equitable.com

Companion cases

If you identify cases as companion cases, we will keep them together throughout the New Business process.

High priority cases

To expediate your high priority cases, it is wise to keep in constant contact with your Relationship Case Manager, and follow high priority best practices.

Term conversions

A term conversion can be made from any term policy, rider or term element (5th dividend) that includes a conversion privilege to convert to a permanent policy. If converting to a permanent policy, the new policy must be issued under the New Business portfolio.

Conforming illustration requirements

Equitable market all life insurance products, except level term products, with illustrations. Policy forms are filed in all jurisdictions with a statement confirming that they are marketed with illustrations.

Temporary Insurance Agreement (TIA)

Temporary insurance coverage on a proposed insured may begin when money is accepted with an application. Read the Temporary Insurance Agreement to learn more.

-

eApp and Drop Ticket

eApp

Life eApp is a web based tool that enables advisors to fully complete their applications electronically from application creation through submission to the Operations Center. It allows for straight through processing when used with e-signature and e-submission, and is the easiest way to ensure that your clients have answered all of the questions needed to process their application.

To access eApp:

Independent Channel – Go to equitable.com and follow the path Quick Links>E- Forms for Life

Equitable Advisors – Go to equitable.com and follow the path Tool>Life eApp

eSign

If electronic signature is selected, the advisor and insured have a choice of In Person or Remote. In Person signature is used when the insured and/or owner are present and all signatures are done using the advisor’s computer. Remote signature is used when the parties will be signing the application through the email link.

eDelivery — for Equitable Advisors Only

Once a policy was been eSigned by the proposed insured, owner and Equitable Advisor, the owner will receive an email that brings them to their policy documents.

Drop Ticket

Use our Drop Ticket program for a faster and more efficient way to submit Term business.

-

Post application

Funding the policy

Acceptable forms of payment include:

- Checks

- Money orders

- Cashier's checks

- Wires

- Initial premium draft

If clients want to pay their initial premiums electronically via ACH from their bank account, they will need to submit all pages of the Systematic Payment form. Register date guidelines

The register date is the date the client’s life insurance coverage takes effect. All charges begin on this date.

Commissions

Contact information:

For Independent Channel:

Email: LifeComp@equitable.com

Phone Number: 866-262-6669, Option 4

Fax Number: 800-657-2911

Mailing Address:

8501 IBM Drive, Suite 150

Attention: Commissions

Charlotte, NC 28262For Equitable Advisors

Email: LifeComp@equitable.com

Phone Number: 866-262-6669, Option 4

Fax Number: 800-657-2911

Mailing Address:

8501 IBM Drive, Suite 150

Attention: Commissions

Charlotte, NC 28262 -

Replacements

Requirements

Many state insurance regulations have articulated a specific definition and procedural requirements for replacement sales that may be in addition to the Company’s policies and procedures. Some states require agents to provide notices or disclaimers to customers if there is existing coverage regardless of whether or not the sale involved a replacement. Other states require customers to sign replacement forms. All appropriate state required replacement forms must be signed and submitted.

Replacing a policy from another carrier

1035 exchange

Equitable will not issue a 1035 policy until the 1035 funds are obtained from the company whose policy is being replaced. If the proposed insured/policy owner submits the full minimum initial premium, Equitable will send a policy to issue without waiting for the 1035 funds, as long as there is not a loan being carried over from the policy being 1035 exchanged. We also need an illustration with the 1035 amount factored in the illustration in order to send the case to issue. It can be signed on delivery if we have a signed illustration on file.

- Replacement Forms - All appropriate state replacement forms must be submitted. State required replacement forms and kits are posted as followed

Regulation 60-NY

Independent Channel

Log in to Equitable and follow the path My Business>New Business>Replacements>NY Regulation 60Equitable Advisors

Contact your branch manager for details.Replacements for term conversion

A term conversion is considered a “change in coverage.” Not all states exempt term conversions from the replacement definition.

Underwriting

-

About Underwriting

How we’re different

We work as a collaborative team, building relationships and adding value while we assess the risks associated with potential clients and strategies. We take a consultative approach, striving to educate our financial professional partners and their clients as we provide holistic underwriting that results in the best offer the first time.

Our team includes:

60 underwriters who are solution-driven and understand the competitive nature of our business.

- 22 years – average experience level

- 40 college degrees and 3 Master’s degrees

- Over 30 industry related Fellowship Designations

- Financial Underwriting Unit: 50 years industry experience assisting with developing financial solutions for complicated or unique case designs, including a CPA and Paralegal/Trust expertise

- Medical Directors: Almost 50 years insurance medical experience, with many past and present industry committee and/or board memberships, including Board of Insurance Medicine and American Academy of Insurance Medicine

Contact us

We're here to assist with your Underwriting needs. If you need to reach out to us, please use our interactive contact map.

-

Proving we deserve your business

Fast turnaround

We are dedicated to providing you with quick and efficient quotes. In fact:

- We have a separate Term underwriting team, that works on Term business only.

- Easy Underwriting is available for a variety of cases, including cases with our Long-Term Care Servicessm Rider, and creates a faster cycle time.

Competitive offers

Equitable is a leading authority on life insurance with a long term care rider, offering one of the most comprehensive riders available for your clients' needs. Now, our Long Term Care Servicessm Rider (LTCSR) is even more competitive for any policy design, including those with a focus on accumulation, with features that help your clients feel confident that their assets will be protected, and they'll have the flexibility they need, when they need it without the typical trade offs.

Proactive communication

Our team is committed to keeping your informed throughout the process with proactive communication and fast responses to your questions.

-

Strengths and niches

Retention and automatic limits

We offer competitive retention and automatic reinsurance limits for standard or better risks in all age groups. And we have the strong financial standing, experience and knowledge to support your large case needs, with retention limits for:

- Individual Coverage: $10M up to age 69 and $5M for ages 70 to 80.

- Survivorship Coverage: $20M up to age 69 and $10M if either life is ≥ age 70.

NT-proBNP

When it comes to matters of the heart, NT-proBNP is an integral part of life underwriting. Read more in this new flyer.

Human Immunodeficiency Virus (HIV)

Under certain circumstances, we will underwrite clients with a history of HIV Infection that have no AIDS defining illness, have been treated with highly active anti-retroviral therapy for the last three years, and have no history or drug or alcohol abuse or addiction.

Human Immunodeficiency Virus (HIV) Case Study

Long-Term Care ServicesSM Rider (LTCSR) (including available on Term conversions)

Our LTCSR is one of the most competitive in the industry today, and it’s available on Term conversions too.

Visit the Long-Term Care Services Rider section for details

High profile individuals

We offer flexibility for professional athletes, teams, and other high-profile clients, with liberal contract requirements, no group or team coverage caps or limits, and policies up to Equitable’s full retention limit. Term policies are available for teams or groups. Both term and permanent policies are available for individuals.

Insuring professional athletes and high profile clients

Professional athlete life insurance process

Professional athlete life insurance case study

Insuring High Profile ClientsCharitable Legacy Rider

Your clients can make donations to their favorite charity as part of their estate plan – using their life insurance policy, without paying any additional fees or charges. Clients can leave up to 1% of their base face amount ($1 million minimum), simply be selecting the rider at policy issue.

Charities can also use life insurance to provide benefits for their executives or owners, and leave the charity itself a donation upon death, using the Charitable Legacy Rider.

Aviation

If you have clients who are private pilots, with at least 300 solo hours of experience, expected to fly 200 hours in the next 12 months, you may want to consider an Equitable insurance policy. Under certain circumstances, we provide high ratings and flexible permanent insurance policies.

Financial Underwriting

Our financial underwriters take a consultative approach to understanding the financial facts and circumstances surrounding each case, making sure that the amount of insurance requested is reasonable and aligned with the proposed insured’s needs. In many cases, this eliminates the need to additional financial information and, in some instances, leads to additional sales.

-

Underwriting guidelines

Life Underwriting Condensed guidelines (including Preferred guidelines)

Quick check guide to see which ratings might apply to your clients, based on medications, family history, blood pressure and driving record. Also includes height and weight requirements, and financial underwriting guidelines, based on policy face amount.

Life Underwriting Condensed Guide

Tobacco guidelines

If clients are currently using tobacco, they will typically be rated as follows:

Tobacco rates for:

- Positive Cotinine urinalysis result.

- Use of cigarettes, e-cigarettes, or hookah.

Standard Non-Tobacco rates for:

- Any nicotine or tobacco products (such as chew, nicotine gum) other than above with urinalysis negative for cotinine.

They may be considered for best class if they use 12 or fewer cigars per year, urinalysis is negative for cotinine, and they otherwise qualify.

If clients used tobacco in the past, they will typically be rated as follows:

- No nicotine or tobacco use in past 5 years – Preferred Elite

- No nicotine or tobacco use in past 3 years – Preferred Non-Tobacco

- No nicotine or tobacco use in past 12 months – Standard Plus

- Former cigar users, less than 12 per year, may be considered at rate otherwise qualified for

Long-Term Care ServicesSM Rider (LTCSR) guidelines

This piece provides guidelines our LTCSR, including underwriting guidelines.

-

Underwriting programs

Easy Underwriting program

Now, more than ever, Equitable is committed to making the purchase of life insurance less invasive for clients. That’s why we’re making changes to our Easy Underwriting program — to give more clients the potential to benefit from underwriting that does not include paramedical exams or labs.

- Easy Underwriting Flyer

- Easy Underwriting FAQ

- Easy Underwriting and eApp Process for Independent Channel

Projected Inheritance

Special program to protect the assets of two generations – the client and the future beneficiaries – by using the assets of one generation to justify life insurance coverage for the next. Planning addresses existing and projected estate tax liability.

Underwriting a Projected Inheritance

Smart Total Evaluation Program (STEP)

This program allows a one-class rating improvement for clients with favorable risk factors and a healthy lifestyle. For example, clients who qualify for a Preferred rating may move up to Preferred Elite using routine age/amount requirements such as insurance labs, paramedical information, and MVRs. Available for all fully underwritten products and both lives on a survivorship policy.

Preferred Client Underwriting Program (PCUP)

If you have clients who purchased a permanent policy within the last three years, went through full underwriting, and were rated Standard or better, they may be able to purchase additional permanent life insurance, within certain limits, without blood or urine testing or financial requirements. Great for those clients whose needs have changed in the last couple years and may be looking for something different.

-

Approved vendors

Approved Paramedical Examination Vendors

APPS

(American Para Professional Services)

1-800-727-2101

ExamOne

(a Quest Diagnostics Company)

1-877-933-9261

Order online to avoid additional fees to Equitable.Approved APS Retrieval Services

1-888-766-3999, or

1-718-575-2000ReleasePoint (Equitable Advisors Only)

1-800-999-9589 Approved Laboratory Testing Services

CRL (Clinical Reference Lab)