Term Series

Term insurance may be a good fit if your clients need extra protection for their families for a specific period of time. It is generally the most affordable type of insurance available.

Why choose our Term Series?

Since your clients can purchase term insurance in large amounts for a relatively low premium, it is well-suited for shorter-term protection goals, such as protection until a mortgage is paid off or children are through college. Proceeds can also be used for final expenses, replacing lost income or to help transition a business.

If their needs change and they need coverage for an extended period of time, your clients can convert the coverage to a permanent policy, up until the end of the level term period but not beyond the insured’s 70th birthday. For Annual Renewable Term, coverage can be converted up until the policy anniversary nearest the insured’s 70th birthday.

Riders

-

Optional rider available at an additional charge:1

-

Rider automatically included:1

Client materials

-

Documents to view or email to clients

Financial Professional materials

-

Marketing materials

- Term Series Producer Fact Card

- Product and Features Guide

- Laddering May Be the Answer

- Attractive Term Series Conversion Provisions

- Term Series FP Presentation (PowerPoint download)

- Term to Perm Comparison Flyer

- TermOne® Convertible Life Insurance Sales

- TermOne® Alternative Term Rates with Advanced Planning Strategies

- Term Conversion Competitive Flyer

- Count on Equitable for life insurance needs

-

Product materials

Product highlights

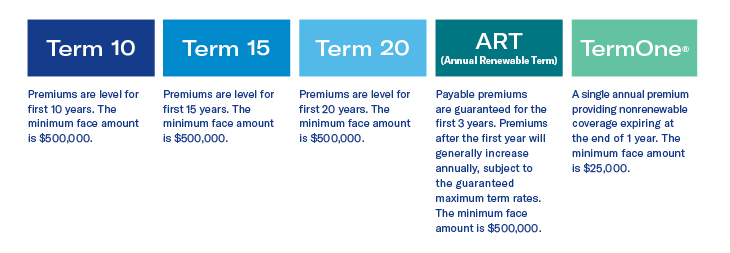

Our Term Series is basic life insurance for which your clients will pay level premiums for a specific period of time – 1, 10, 15 or 20 years – or they’ll pay premiums that are renewable and will increase each year as they get older. It pays a guaranteed death benefit to your clients’ beneficiaries that is generally income-tax-free, if they should die during that time period.

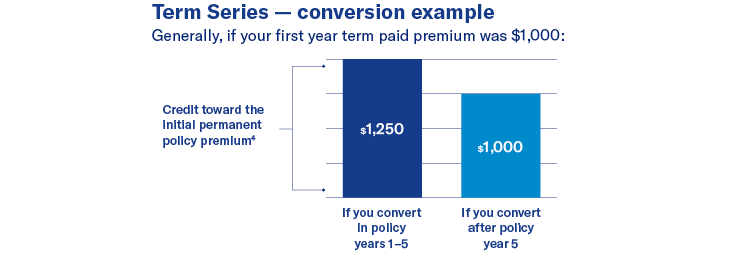

Term Series conversion2

Only Equitable offers a conversion credit until the end of the level term period and a 25% increase in the credit if converted in the first 5 policy years. Plus, clients have the option to apply to add our Long-Term Care Servicessm Rider.3

Why should clients convert from term to permanent life insurance?

- They won’t have to answer more health questions or undergo a medical exam.

- They can potentially build cash value with a permanent policy.

- Their first year permanent policy premium will generally be reduced.

Prospective client

- Age 18-70 (65 for Term 20)

- Doesn't need lifetime protection or can’t afford it now

- Has specific and often temporary coverage needs, such as protection for the family until the mortgage or other debts are paid off or the children are through college

1 All riders are subject to the terms and conditions of the rider. All riders may not be available in all jurisdictions. Some states may vary the terms and conditions. There may be an additional charge associated with obtaining certain riders. Some riders may not be available in combination with other riders and/or policy features. Only automatically included qualified plan riders are available with TermOne®.

2 A conversion credit is not available for TermOne® policies.

3 See Term Conversions section of the Term Series 160 Product Guide for how the term conversion credit is determined. A conversion credit is not available if premiums or charges for the new policy will be waived under the terms of a rider providing disability waiver benefits. Conversion credit is not available for TermOne® policies. Policies converted within the first policy year will receive a prorated conversion credit subject to terms and conditions of the policy.

4 After five years, we reserve the right to limit the permanent product offered.

Term Series products are issued in New York and Puerto Rico by Equitable Financial Life Insurance Company, NY, NY; and in all other jurisdictions by Equitable Financial Life Insurance Company of America, an Arizona stock corporation with its main administrative office in Jersey City, NJ. Distributed by Equitable Network, LLC (Equitable Network Insurance Agency of California, LLC in CA; Equitable Network Insurance Agency of Utah, LLC in UT; and Equitable Network of Puerto Rico, Inc. in PR); and Equitable Distributors, LLC, NY, NY. When sold by New York state-based (i.e., domiciled) financial professionals, Term Series products are issued by Equitable Financial Life Insurance Company, 1290 Avenue of the Americas, New York, NY 10104.

TermOne® is a registered service mark of Equitable Financial Life Insurance Company. TermOne® is issued by Equitable Financial Life Insurance Company in all jurisdictions. TermOne® is also issued by Equitable Financial Life Insurance Company of America (Equitable America) in all jurisdictions except NY and PR.

Contract form #s: Level Term Policy Form #s ICC14-156-LT, 156-LT, or state variation. ART Policy Form #s- ICC14-156-54, 156-54, or state variation. TermOne® Policy Form #s ICC07-148-51, 148-51, or state variation.