VUL Legacy®

Permanent life insurance, like VUL Legacy®, can be a smart addition to many financial plans for policyholders who want a better way to protect their family, reduce taxes and potentially grow their money more quickly over time.

Get the facts

Discover how VUL Legacy® can help provide lifetime protection for policyholders, with a variety of investment options to choose from.

Choosing investment options

With VUL Legacy®, policyholders have the flexibility to choose from over 80 investment options. Learn about them here.

Tax-efficient retirement planning

Uncover the benefits of using a 7702 cash value life insurance policy to manage policyholders' tax brackets in retirement.

Why choose VUL Legacy®?

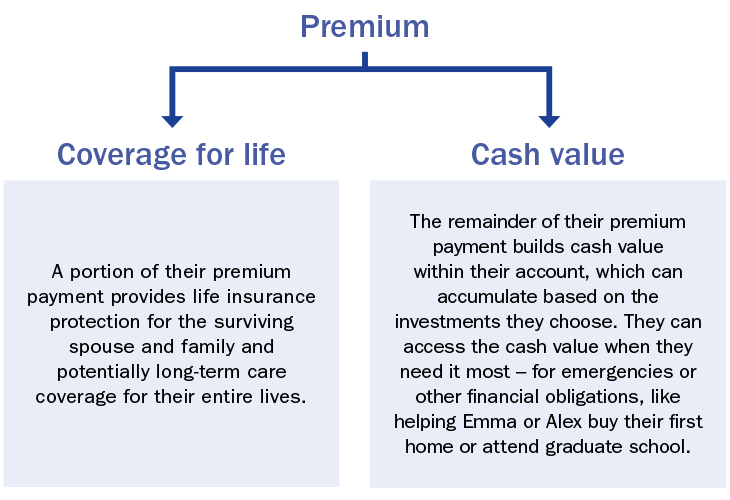

VUL Legacy® is designed to offer policyholders a cost-effective death benefit with potential cash value growth. It provides financial protection for policyholders and gives them the flexibility to allocate their premiums to a wide variety of investment options to ensure their money is invested the way they want. It provides a way for policyholder to live more for today, keep more of what they earn and build more for the future.

Live More

Unlike term insurance, VUL Legacy® protects policyholders' families for their entire lives, as long as required premiums are paid, while adapting throughout their lives to provide access to the cash they need, when they need it.

- Lifetime death benefit provided required premiums are paid

- Flexibility to access their money through cash surrender value1

Keep More

VUL Legacy® helps policyholders keep more of their money by minimizing taxes and allowing contribution limits that are up to the MEC limits1 and generally no income taxes on any money they pass along.

- Generally income tax-free death benefit

- Contribution limits that are up to the MEC limits1

Build More

With VUL Legacy®, policyholders’ cash value can grow over time. VUL Legacy® can build their assets more quickly over time with true tax-deferred growth and potentially distributions.1

- Tax-deferred growth helps build assets over time

- Wide range of investment choices

- Flexibility to change investments as policyholders’ lives change

-

Optional riders available at an additional charge:2

- Long-Term Care Servicessm Rider

- Market Stabilizer Option® (charge only if exercised)

- Children’s Term Insurance Rider

- Disability Waiver of Monthly Deductions Rider

- Option to Purchase Additional Insurance Rider

-

Optional rider available at no additional charge:2

- Charitable Legacy Rider®

-

Riders automatically included at no additional charge:2

- Living Benefits Rider

- Loan Extension Endorsement

- Paid Up Death Benefit Guarantee

Client materials

Financial Professional materials

To view Financial Professional materials, please log on to equitable.com

Prospectus and Supplements

-

Prospectus

Product highlights

VUL Legacy® is a flexible premium variable universal life insurance product designed to maximize policyholders' protection efforts:

- Offers some of the most competitive level-pay premiums in the industry today.

- Provides more than 80 investment options to help investors plan for a long-term strategy.

- Wide selection of index options make investing simpler.

- Asset allocation3 options — from conservative to aggressive — for the less active investor.

- More than 60 additional equity and fixed income options offering access to some of the best money managers in the world.

- Helps investors stay the course during market downturns with our Market Stabilizer Option®

- Take advantage of growth opportunities and help protect against market declines, The Market Stabilizer Option® ("MSO") is an investment option that offers a rate tied to the performance of the S&P 500® Price Return Index (which does not include dividends). The MSO allows your clients participation in limited upside performance potential of the S&P 500® Price Return Index up to a growth cap rate that is set each month by the insurance company. It also provides limited downside protection against declines of up to -25%. The MSO has a charge of 1.15% with a maximum of 2.40%.

VUL Legacy® in action

Jay and Melissa

- Parents of Emma, 5, and Alex, 3

- Expecting a third child this year

- Have life insurance through their employers

- Want permanent long-term care coverage

Goal: Melissa and Jay are comfortable with investments since they contribute to their 401(k) plans. They want a permanent long-term strategy that will help them ride out market fluctuations and protect them against the potentially high cost of long-term care, even if they change jobs or one parent decides to stay at home after the baby comes. Melissa and Jay both choose an individual VUL Legacy® policy.

Loans and partial withdrawals will decrease the death benefit and cash value of a client’s life insurance policy and may be subject to policy limitations and income tax. In addition, loans and partial withdrawals may cause certain policy benefits or riders to become unavailable and may increase the chances a client’s policy may lapse.

Please remember, this contract does have 15 years of surrender charges along with other charges including but not limited to cost of insurance charges, a front end load, investment management fees, mortality and expense risk charge, transaction charges, rider charges and monthly administration charges. Please make sure you and your client consider this before purchasing a contract.

Prospective policyholder

- May be a more financially sophisticated investor

- Age 30-60

- Has a need for life insurance protection

- Looking for cost-effective protection

- Moderate to moderate-aggressive risk tolerance

- Wants to be able to fully participate in financial market performance

- Looking for an alternative option to cover long-term care expenses

- Wants a source from which he or she may potentially access cash for future needs

1 Under current federal tax rules, you generally may take income-tax-free partial withdrawals under a life insurance policy that is not a modified endowment contract (MEC), up to your basis in the contract. Additional amounts are includible in income. The IRS places a limit on how much money can go into life insurance premiums for the policy and how quickly such premiums can be paid in order for the policy to retail all of its tax benefits. If certain limits are exceeded, a MEC results. MEC policyholders may be subject to taxes on distributions on an income-first basis, that is, to the extend there is gain in their policies, and penalties, and penalties on any taxable amount if they are not age 59½ or older. Loans taken will be free of current income tax as long as the policy remains in effect until the insured's death, does not lapse, and is not a MEC. Please note that outstanding loans accrue interest. Income-tax-free treatment also assumes the loan will eventually be satisfied from income-tax-free death benefit proceeds.

Loans and withdrawals reduce the policy's cash value and death benefit, may cause certain policy benefits or riders to become unavailable, and may increase the chance the policy may lapse. If the policy lapses, is surrendered or becomes a MEC, the loan balance at such time would generally be viewed as distributed and taxable under the general rules for distribution of policy cash values. In addition, withdrawals, policy loans and any accrues loan interest may cause your policy to lapse even if you are in a period of coverage under the No Lapse Guarantee Rider. Speak to your financial professional before taking any withdrawals or policy loans.

2 All riders are subject to the terms and conditions of the rider. All riders may not be available in all jurisdictions. Some states may vary the terms and conditions. There may be an additional charge associated with obtaining certain riders. Some riders may not be available in combination with other riders and/or policy features.

3 Asset allocation is a method of diversification, it does not guarantee a profit nor protect against a loss.

Please be advised that this guide for producers is not intended as legal or tax advice. Accordingly, any tax information provided in this guide for producers is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transaction(s) or matter(s) addressed, and clients should seek advice based on their particular circumstances from an independent tax advisor.

This webpage is not a complete description of all the material provisions of the VUL Legacy® variable life insurance policy. This webpage must be preceded or accompanied by the VUL Legacy® product prospectus and any applicable prospectus supplements. The prospectuses contain more complete information about the policy, including investment objectives, risks, charges, expenses, limitations and restrictions. Please read the prospectuses which you can access through the link above and consider the information carefully before purchasing a policy or sending money.

VUL Legacy® is a flexible premium variable life insurance policy issued in New York and Puerto Rico by Equitable Financial Life Insurance Company, NY, NY; and in all other jurisdictions by Equitable Financial Life Insurance Company of America, an Arizona stock corporation with its main administrative office in Jersey City, NJ. Distributed by Equitable Advisors, LLC (member FINRA, SIPC) (Equitable Financial Advisors in MI and TN) and Equitable Distributors, LLC, NY, NY. When sold by New York state-based (i.e., domiciled) Equitable Advisor financial professionals, VUL Legacy® is issued by Equitable Financial Life Insurance Company, 1290 Avenue of the Americas, New York, NY 10104.

Equitable Financial, Equitable America, Equitable Advisors, Equitable Network and Equitable Distributors do not provide tax or legal advice. Certain types of policies, features and benefits may not be available in all jurisdictions or may be different.

VUL Legacy® is sold by prospectus only. The prospectus contains complete information on investment options, fees, and charges. Clients should read the current prospectus before investing or sending money.

VUL Legacy®, Charitable Legacy Rider® and Market Stabilizer Option® are registered service marks and Long-Term Care Servicessm Rider is a service mark of Equitable Financial Life Insurance Company.

Policy form #s ICC09-100, #09-100 or state variations.

Market Stabilizer Option® form #s ICC15-R15-200, R15-200 or state variations (not available in New York).