Do your clients’ life policies still meet their needs?

Determine whether to adjust your clients’ policies, based on a review of the initial purpose for the coverage, product features and performance, and personal or insurance carrier health changes.

How does this strategy work?

You can use Equitable’s PPH Exam (Policy, Purpose, Health Exam) to determine whether your clients’ life insurance should be adjusted (or if there are other opportunities for coverage), based on a review of: (1) the initial purpose of the coverage; (2) product features and performance; and (3) personal or insurance company health changes.

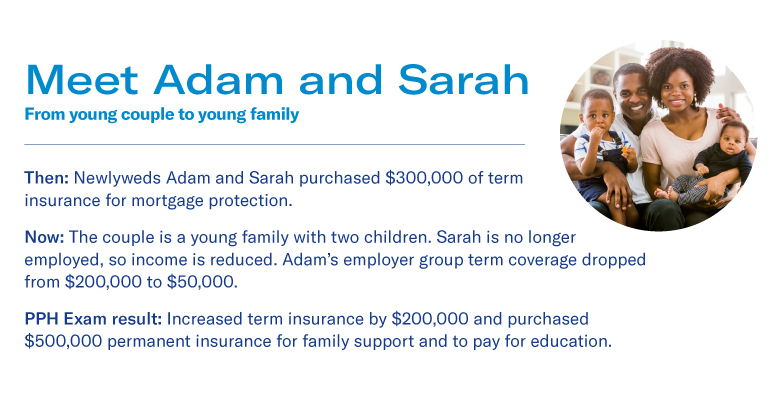

Focus on the purpose

Since priorities shift, time horizons move, and personal financial situations change, reviewing the purpose of a life insurance policy may uncover opportunities. Here’s an example:

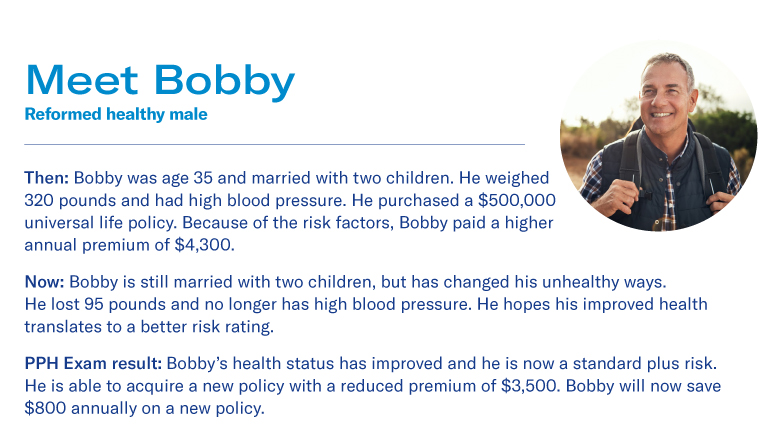

Focus on the product

Life insurance policies may not always perform as projected, or the need for a particular kind of policy may change over time. Here’s an example:

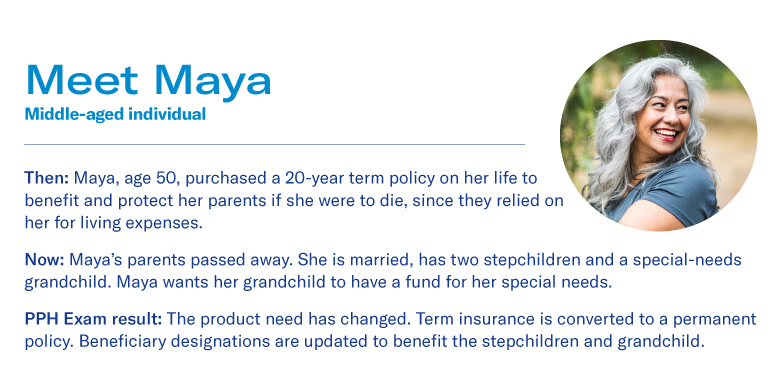

Focus on health

Reviewing your clients’ health and identifying whether the insurance company has updated their risk assessment for certain medical conditions can yield valuable information. Here’s an example:

Highlighted product(s) with this concept

See all accumulation products

See all permanent protection products

See all temporary protection products

See all wealth transfer products

Client materials

-

Documents to view or email to clients