Simple buy-sell for two business owners

Consider a cross purchase buy-sell agreement when two people own a business together and want to make sure that the business continues if something happens to one of them.

How does this strategy work?

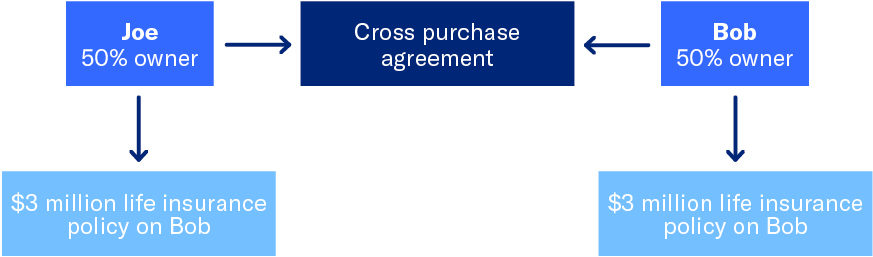

A buy-sell agreement is a contract that provides for the future sale of a business interest between business owners. In a cross purchase buy-sell agreement, each co-owner buys a life insurance policy on the life of the other co-owner, pays the annual premium and is the beneficiary of the policy they own. While this strategy can be used with more than two owners, it is generally only used with businesses that have two owners.

When one owner dies, the life insurance benefit received by the surviving owner allows them to buy the business interest from the deceased owner’s estate.

Benefits of this strategy:

- The life insurance proceeds will not trigger Corporate Alternative Minimum Tax (AMT), because the policy is owned by an individual, not a C Corporation.

- The policies and cash values are not subject to creditors of the business.

- The surviving shareholder will receive full basis credit for the purchase of the stock. This will reduce any capital gains tax when the surviving owner eventually sells the business.

Considerations to keep in mind:

- The owners need to use their own after-tax funds to purchase the life insurance policies.

- If the owners are different ages or would be rated differently, one may have to pay a disproportionate amount of premiums.

- The company cannot record the cash value in the policy as a business asset.

Strategy in action

- Joe, age 50, and Bob, age 46, each own 50% of Acme Manufacturing, which has been appraised at $6 million. They want to establish a buy-sell agreement so that the other owner could continue the business if one passes away.

- Joe buys a $3 million life insurance policy on Bob. Joe is the owner of the policy, will make the premium payments and will be the beneficiary.

- Bob buys a $3 million life insurance policy on Joe. Bob is the owner of the policy, will make the premium payments and will be the beneficiary.

Bob unexpectedly passes away a few years later…

- Joe receives the tax-free life insurance benefit of $3 million.

- He uses that money to purchase Bob’s share of the business from Bob’s estate.

Prospective client

- Business with two owners

- Wants a simple way to ensure that the business will continue if one owner passes away

- Worried about paying corporate Alternative Minimum Tax (AMT)

Highlighted product(s) with this concept

BrightLife® Grow

VUL Optimizersm

Financial Professional materials

-

Marketing materials

Please be advised that this material is not intended as legal or tax advice. Accordingly, any tax information provided in this material is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transaction(s) or matter(s) addressed and your clients should seek advice based on their particular circumstances from their own tax and legal advisors.

Life insurance products are issued by Equitable Financial Life Insurance Company (New York, NY) or Equitable Financial Life Insurance Company of America (Equitable America), an Arizona stock corporation with its main administration office in Jersey City, NY and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Agency of California in CA; Equitable Network Insurance Agency of Utah in UT; Equitable Network of Puerto Rico, Inc. in PR), and Equitable Distributors, LLC. Variable Products are co-distributed by Equitable Advisors, LLC (Member FINRA, SIPC) (Equitable Financial Advisors in MI and TN) and Equitable Distributors, LLC and Equitable Distributors, LLC. Equitable, Equitable America, Equitable Advisors, Equitable Network and Equitable Distributors do not provide tax or legal advice.