Retain key employees with a Stay Bonus

A Stay Bonus can help business owners feel more confident about the future of their business. If the owner dies, the Stay Bonus can help keep the key employees with the company for long enough to successfully transition the business.

How does this strategy work?

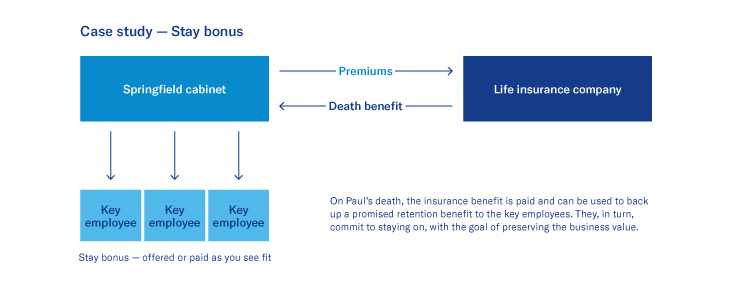

By implementing a properly structured Stay Bonus plan, your business-owner clients can help ensure the successful transition of their business after their death. The business itself would purchase life insurance on the life of the owner. If your clients use permanent life insurance, the cash surrender value can be included as an asset on the business’ balance sheet. Then, upon the death of the owner, the company can identify key individuals who are needed to keep the business stable and running smoothly, and can then offer those individuals a retention bonus, which can be funded with the life insurance proceeds.

Strategy in action:

- Paul owns a high-profile cabinet company (“Springfield Cabinet”). His son and daughter-in-law work for him and will take over the business in the near future.

- The continued success of his business depends on three key employees: a sales person with strong contractor relations, a shipping manager, and their own staff accountant.

- He is worried that if he dies, those key employees might take jobs with competitors.

- The business implements a Stay Bonus plan.

- In the event of Paul’s death, the company would receive the life insurance benefit income-tax-free, and would be able to offer a retention bonus to the three non-family member executives to help stabilize the business.

Prospective client

- Established business with key executives in addition to the owner

- The owner plans to transfer the business to family or another owner

- The owner is insurable

- There is a risk that the key executives will leave the business if the owner dies, therefore destabilizing the business

Highlighted product(s) with this concept

BrightLife® Grow

VUL OptimizerSM

Client materials

-

Documents to view or email to clients

Please be advised that this webpage is not intended as legal or tax advice. Accordingly, any tax information provided in this article is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transaction(s) or matter(s) addressed, and your clients should seek advice based on their particular circumstances from an independent tax advisor. Neither Equitable nor its affiliates provide legal or tax advice.

Life insurance products are issued by Equitable Financial Life Insurance Company (New York, NY) or Equitable Financial Life Insurance Company of America (Equitable America), an Arizona stock corporation with its main administration office in Jersey City, NY and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Agency of California in CA; Equitable Network Insurance Agency of Utah in UT; Equitable Network of Puerto Rico, Inc. in PR), and Equitable Distributors, LLC. Variable Products are co-distributed by Equitable Advisors, LLC (Member FINRA, SIPC) Equitable Advisors in MI and TN and Equitable Distributors, LLC. When sold by New York based (i.e. domiciled) financial professional life insurance is issued by Equitable Financial Life Insurance Company.