What’s the return on a lifetime?

Your clients may think that their family could build more money for the future if they self-insure and invest their money in a product other than life insurance. But, have they looked at the internal rate of return life insurance can provide at death?

How does this strategy work?

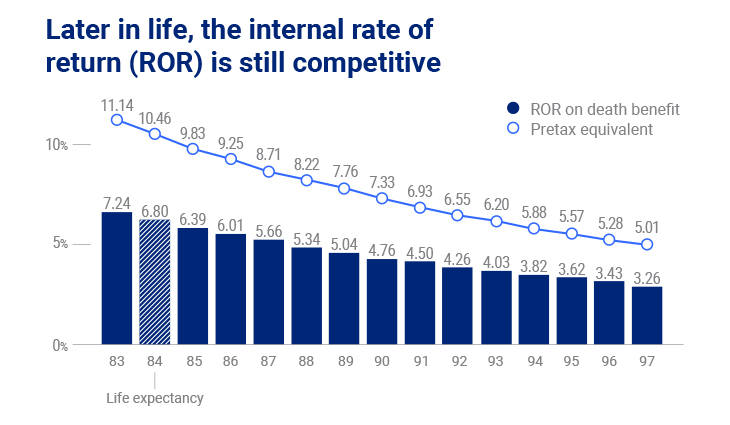

By purchasing life insurance with a relatively small premium, your clients can generate a substantial death benefit, which can help them provide the assets needed to make sure their loved ones are financially secure. This works because life insurance provides leverage, so the internal rate of return for life insurance can be substantial, not only in the short-term, but all the way through life expectancy.

Strategy in action

- Peter is age 55

- He needs $1 million in life insurance

- He pays $11,100 per year in premiums for that benefit1

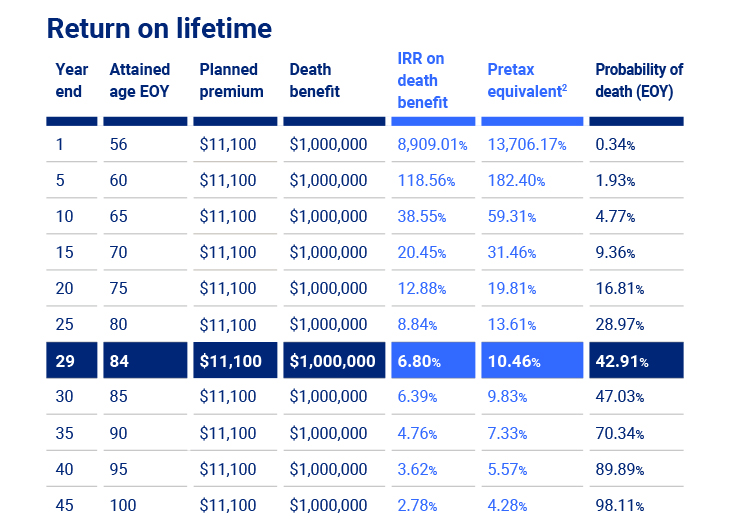

Here’s what another investment would have return annually (pre-tax) to keep pace with the life insurance benefit.

Internal Rate of Return at Death

Note that by the age of 84 (life expectancy) there is a 42.91% chance of death occurring based on the 2017 CSO Table.

- An alternative product must have earned 6.8% after-tax to equal the insurance death benefit, or

- Alternative product must have earned 10.46% pre-tax (assumes a 35.00% tax rate) to equal the insurance death benefit.

1 The life insurance values represented here are for a preferred, non-tobacco male, non-guaranteed and assume current charges and a current interest rate of 6.12% + 0.50 (Extra Interest Credit).

2 Based on a 35.00% income tax bracket.

Prospective client

- Age 50-70

- Needs insurance but isn’t convinced it’s a “good deal”

- Wants to provide a substantial benefit for children or grandchildren at death

- Is healthy and can buy life insurance at a reasonable price

Highlighted product(s) with this concept

VUL Survivorship

Please be advised that this webpage is not intended as legal or tax advice. Accordingly, any tax information provided is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transaction(s) or matter(s) addressed, and clients should seek advice based on their particular circumstances from an independent tax advisor. Neither Equitable nor its affiliates provide legal or tax advice.

Life insurance products are issued by Equitable Financial Life Insurance Company (New York, NY) or Equitable Financial Life Insurance Company of America (Equitable America), an Arizona stock corporation with its main administration office in Jersey City, NY and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Agency of California in CA; Equitable Network Insurance Agency of Utah in UT; Equitable Network of Puerto Rico, Inc. in PR), and Equitable Distributors, LLC. Variable Products are co-distributed by Equitable Advisors, LLC (Member FINRA, SIPC) (Equitable Financial Advisors in MI and TN) and Equitable Distributors, LLC. When sold by New York based (i.e. domiciled) financial professionals life insurance is issued by Equitable Financial Life Insurance Company (New York, NY).