Increasing wealth transfer using deferred annuity distributions

If your clients own deferred annuities they don’t need for their own retirement, they may want to help maximize their wealth transfer (and help minimize taxes) by using distributions from the annuities to help fund a permanent life insurance policy.

How does this strategy work?

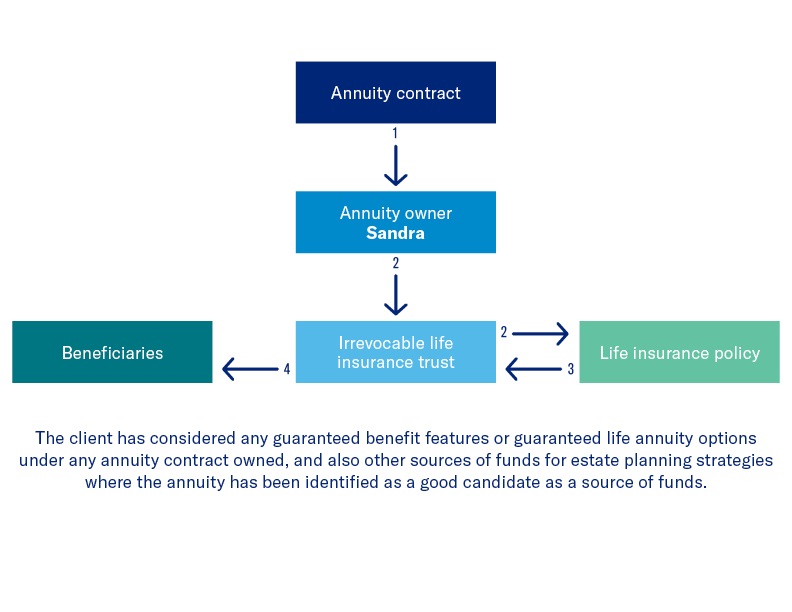

Instead of passing unused non-qualified annuity assets to family members at death – which could trigger both estate and income taxes – your clients can take withdrawals from the annuity during their lifetime to fund a life insurance policy. They would need to gift the withdrawals to an Irrevocable Life Insurance Trust (ILIT), which would in turn purchase a life insurance policy with the assets. At the client’s death, the life insurance benefit is paid to the ILIT (tax-free, if structured properly). The ILIT assets then pass to the family members per the trust provisions.

Here’s an example of how to transfer more annuity wealth:

- Sandra is 65 with three grown children.

- She has a substantial amount in an annuity, which she doesn’t need for retirement income.

- She takes annual withdrawals for a set number of years. A portion of the withdrawal may be subject to income taxation.

- She gifts the after-tax withdrawal to an Irrevocable Life Insurance Trust (ILIT), which purchases a life insurance policy.

- Upon her death, the life insurance benefit is paid to the ILIT income-tax-free and not included in Sandra's taxable estate.

- The ILIT assets then pass to her children per trust provisions.

- Any unused annuity balance also passes to her children. These assets are included in Sandra’s taxable estate and when distributed to her children, they will pay income tax on any growth.

- If she hadn’t used this strategy, and the annuity that Sandra did not need continued to grow, her estate would have continued to grow, resulting in greater taxes paid to the government upon her death.

- However, by using the annuity distribution to fund a life insurance in an ILIT, Sandra can leave a greater legacy benefiting her children and less in taxes to the IRS.

Prospective client

- Age 60-85

- Owns deferred annuities, which are not needed for retirement income

- In a high income tax bracket

- Would like to maximize wealth transfer to beneficiaries

Highlighted product(s) with this concept

VUL LegacysmSee all permanent protection products

VUL Survivorship

Financial Professional materials

-

Marketing materials

To determine how this approach would work with your clients, individual illustrations should be prepared or requested for review.

Existing annuity provisions should be reviewed prior to taking a withdrawal. Annuities are long-term investments designed for retirement. Withdrawals will reduce the death benefit and any optional benefits.

Life insurance products are issued by Equitable Financial Life Insurance Company (New York, NY) or Equitable Financial Life Insurance Company of America (Equitable America), an Arizona stock corporation with its main administration office in Jersey City, NY and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Agency of California in CA; Equitable Network Insurance Agency of Utah in UT; Equitable Network of Puerto Rico, Inc. in PR), and Equitable Distributors, LLC. Variable Products are co-distributed by Equitable Advisors, LLC (Member FINRA, SIPC) (Equitable Financial Advisors in MI and TN) and Equitable Distributors, LLC.

Please be advised that this webpage is not intended as legal or tax advice. Accordingly, any tax information provided is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transaction(s) or matter(s) addressed, and clients should seek advice based on their particular circumstances from an independent tax advisor. Neither Equitable nor its affiliates provide legal or tax advice.