Using Projected Inheritance to obtain younger clients

For older clients with substantial wealth, you can use the children’s projected inheritance to justify the amount of life insurance they might need later, but can’t afford now.

How does this strategy work?

By using Equitable's Projected Inheritance Underwriting Program, Financial Professionals can help an older generation pass assets to their children, and develop a stronger relationship with the next generation of clients in the process. With this program, we will underwrite the younger generation medically, but add all or a portion of the older generation’s assets into the mix, based on an anticipated inheritance.

This allows the younger generation to purchase life insurance while they’re still in good health (thus paying less), and can help you connect and build a relationship with a generation that you might not otherwise have as a long-term client.

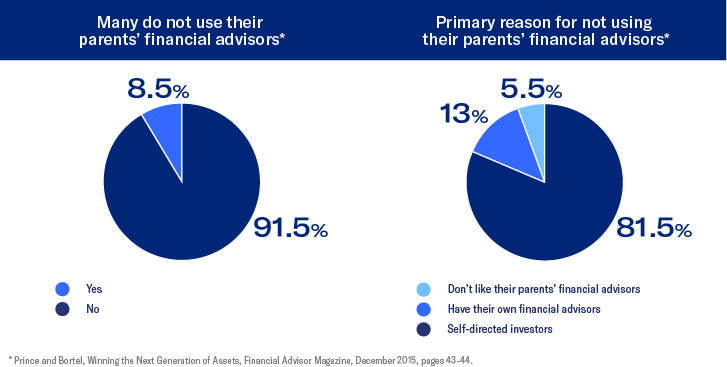

Most children don’t use their parents’ financial advisors.

You can give them a reason to stay with you, by providing the life insurance they need, when they need it.

Strategy in action

Margaret is a 75-year-old mother and grandmother, worth $16 million. She wants to reduce her taxable estate and help her daughter, Jill, protect her family.

Jill has children of her own and needs life insurance to protect them and the inheritance she will receive from her mother. However, she doesn’t qualify for the amount of life insurance she needs using just her assets. She has a moderate risk tolerance and is leery of the markets.

Using Equitable’s Projected Inheritance Underwriting Program, Margaret purchases an indexed universal life policy, with a $35 million death benefit on Jill, after moving $4 million of her liquid assets into an irrevocable life insurance trust for Jill. What does this accomplish?

- Gives Jill the life insurance she needs to protect her family and take care of future tax needs.

- Covers Jill at a time when she is in good health, so her cost is lower than if she waited.

- Provides Jill with some upside potential and guaranteed downside protection.

- Allows Margaret to substantially reduce her taxable estate and leave even more wealth to Jill than originally expected.

Prospective client

- Older generation planning to pass assets to a younger generation

- Has already set up a will or estate plan, documenting the anticipated transition of assets to the younger generation

- Younger generation must have a need for life insurance, potentially more than they can afford or justify with their current assets

Highlighted product(s) with this concept

BrightLife® Grow

VUL OptimizerSM

Financial Professional materials

Clients must provide established estate planning documents that exhibit generational wealth transfer. See Projected Inheritance Financial Underwriting Guidelines for more detail.

Life insurance products are issued by Equitable Financial Life Insurance Company (New York, NY) or Equitable Financial Life Insurance Company of America (Equitable America), an Arizona stock corporation with its main administration office in Jersey City, NY and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Agency of California in CA; Equitable Network Insurance Agency of Utah in UT; Equitable Network of Puerto Rico, Inc. in PR), and Equitable Distributors, LLC. Variable Products are co-distributed by Equitable Advisors, LLC (Member FINRA, SIPC) (Equitable Financial Advisors in MI and TN) and Equitable Distributors, LLC.

Please be advised that this webpage is not intended as legal or tax advice. Accordingly, any tax information provided in this article is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transactions or matters addressed, and clients should seek advice based on their particular circumstances from an independent tax advisor. Equitable Financial and its affiliates do not offer legal or tax advice.