How will tax reform affect your clients?

Learn how the Tax Cut and Jobs Act will affect your individual, corporate and small business clients, as well as the new lifetime exemption amount for estate and gift taxes.

Tax changes for individuals

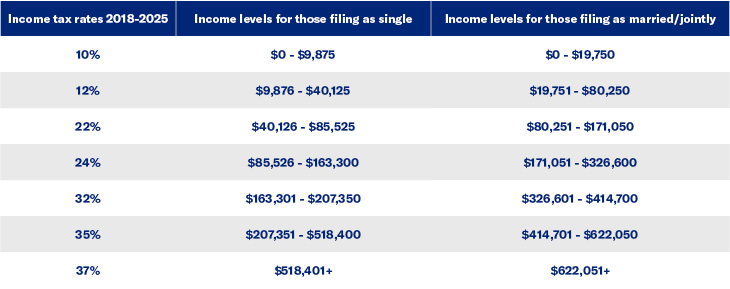

The new tax bill maintains the current number of tax brackets but drops the tax rates for all but the lowest income levels. The chart below is the 2020 brackets and rates.

Several important changes were implemented from the prior tax code, including:

- The standard deduction increases from $6,500 (individuals), $9,550 (heads of household), and $13,000 (married, filing jointly) to $12,400, $18,650 and $24,800 in 2020, respectively.

- Personal exemptions of $4,050 for each dependent will no longer be available.

- Where someone does itemize their deductions:

- State and local income, sales and property taxes will be capped at $10,000.

- Mortgage interest deductions are capped at $750,000 for new mortgages and the home equity interest deduction is repealed.

- Charitable contribution limit increases to 60% of adjusted gross income for cash contributions.

- No more deductions for alimony payments or inclusion of alimony into income.

- Higher exemptions for the Alternative Minimum Tax (AMT) — up to $72,900 for individuals and $113,400 for married, filing jointly.

- Cost of living adjustments increase under what is known as “Chained CPI (Consumer Price Index).” The effect is to temper the growth in some benefit cost of living adjustments.

What to do?

Most of these individual tax changes are scheduled to sunset after 2025. Therefore, financial professionals and their clients should consider any changes carefully. You may also want to remind your clients that Congress came close to reducing deductible 401(k)s, so they should continue to be self-sufficient in their retirement planning efforts.

Tax changes for corporations

Prior to the tax changes, corporate tax rates were between 15% and 35%. In 2018, the top rate was set at 21%, the lowest Federal corporate tax rate since 1939. In addition, the Corporate Alternative Minimum Tax (AMT) of 20% is repealed. Unlike individual tax law changes, these changes are permanent — at least until the next time Congress changes.

What to do?

For businesses that are incorporated with net income over $50,000, the new lower tax rate could offer tax relief, leaving more profits for possible benefit or protection planning related to top employees — these can include Key Person protection or Executive Benefit programs. You may want to talk to your clients about permanent cash value life insurance as a way to both help plan for these needs and build cash values for other retirement needs.

Tax changes for S-Corps, Partnerships, LLCs and sole proprietors

With the new law, small businesses that are taxed as pass-through entities may deduct 20% of their pass-through income from their personal income taxes, but there are limitations. Once you hit an income threshold of $163,300 (single) or $326,600 (married), there are limitations or tests depending on the type of business you have. For manufacturing and sales businesses, there is a cap of 50% of the total payroll W-2 income or 2.5% of their depreciable assets. For professional service firms, such as doctors and lawyers, the 20% deduction is phased out for incomes over $163,300 (single) or $326,600 (joint).

What to do?

With more available cash in hand, pass-through entities may want to use the additional funds to help their business planning. If they have top managers, they may want to consider Key Person protection and Executive Compensation plans. Your business owner clients may look to purchase life insurance policies to max fund individually owned cash value/accumulation contracts on a tax preferred basis and supplement their retirement income.

Because the 20% deduction for pass-through entities will expire at the end of 2025, you may want to consider working with your client sooner rather than later to put this planning in place. Financial professionals may also want to talk to their clients about converting their entity from a pass-through to a C-Corporation (their tax changes remain permanent), or whether it makes sense to break the entity into multiple entities to take advantage of new rules around real estate and depreciable property. Keep in mind that future Congress can always reverse the laws so any major changes should be done with careful planning.

Estate and gift tax law changes

As of 2020, the lifetime exemption for estate and gift taxes will be $11,580,000 for individuals and $23,160,000 for married couples — double what it was in 2017. These provisions will sunset in 2026 and revert to the prior rates.

What to do?

While these changes only affect a small portion of America’s population and will sunset after 2025, they may be important to some of your clients. Therefore, you may want to help your clients plan for any asset and estate transfer with an aim toward flexibility.

Related content

Sales Concepts

Using Life Insurance to Help Minimize Taxes in Retirement

If your clients expect to be in a high tax bracket in retirement or are worried about taxes rising, they can use cash value life insurance to help supplement their retirement income.

Client materials

-

Documents to view or email to clients

Financial Professional materials

-

Marketing materials

Life insurance products are issued by Equitable Life Insurance Company (NY, NY) or Equitable Financial Life Insurance Company of America (EFLOA), an Arizona stock corporation with its main administration office in Jersey City, NJ 07310 and are co-distributed by affiliates Equitable Network, LLC (Equitable Network Insurance Agency of California in CA; Equitable Network Insurance Agency of Utah in UT; Equitable Network of Puerto Rico, Inc. in PR), and Equitable Distributors, LLC. Variable products are co-distributed by Equitable Advisors, LLC (Member FINRA, SIPC) (Equitable Financial Advisors in MI and TN) and Equitable Distributors, LLC. When sold by New York based (i.e. domiciled) financial professionals life insurance is issued by Equitable Financial Life Insurance Company (NY, NY).

All companies are affiliated and directly or indirectly owned by Equitable Holdings, Inc., and do not provide tax or legal advice.