1040 Overlay Program: Uncover planning opportunities for your clients

Our 1040 program makes it easy to identify specific planning opportunities placing specially design transparencies on top of your clients’ tax returns (1040) to find planning opportunities in cooperation with clients' CPAs and other advisors.

Our digital 1040 Guidebook provides you with:

- What changes were made in 2020

- Brief planning opportunities with summaries for specific line items highlighted by the 1040 overlay transparencies

- Thumbnails you can click on to view brochures and flyers with relevant financial strategies to discuss with your clients

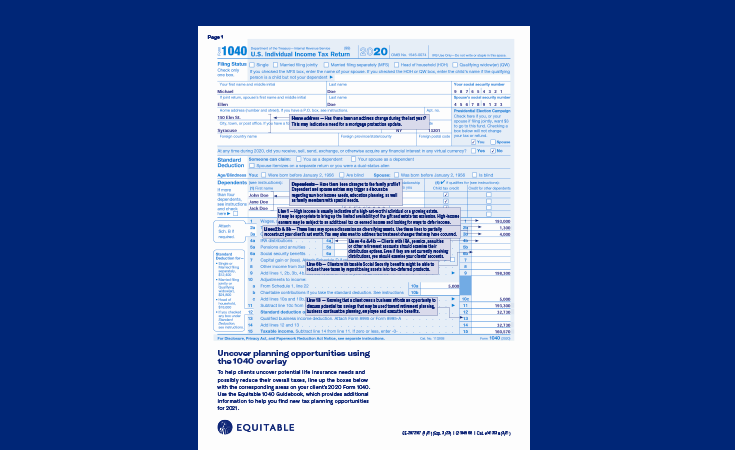

How does the strategy work?

Your clients’ tax returns can provide a wealth of information for planning opportunities. The 1040 overlay points to specific sections of the tax return that you might find helpful and informative – and provides planning suggestions for each. It’s as easy as lining up the pages. The 1040 guidebook and transparency overlays provide additional resources to help you decide if additional coverage or planning is necessary. This is also a powerful way to work with tax advisors to show them planning opportunities they may not normally recognize.

Strategy in action

Here’s an example of using the 1040 overlay for hypothetical clients, James and Sarah:

|

On James and Sarah’s tax return, you can see that they: |

Which could mean: |

|

Earn high W-2 income |

They may be subject to additional tax on earned income and looking for ways to defer income. If they earn over a certain amount, they may not qualify for deductible IRAs or Roth IRAs, and may want to explore a “Roth IRA Alternative.” |

|

Have interest and dividend income |

They may have other assets you don’t know about. You could help them diversify assets into lower-taxed or tax-deferred assets, such as annuities or life insurance. |

|

Take real estate-related deductions |

They may own rental property, which is an illiquid asset that requires specialized planning. |

Client materials

Financial professional materials

Please be advised that this webpage is not intended as legal or tax advice. Accordingly, any tax information provided in this article is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transaction(s) or matter(s) addressed, and your clients should seek advice based on their particular circumstances from an independent tax advisor. Neither Equitable nor its affiliates provide legal or tax advice.

Life insurance products are issued by Equitable Financial Life Insurance Company (New York, NY) or Equitable Financial Life Insurance Company of America (Equitable America), an Arizona stock corporation with its main administration office in Jersey City, NY and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Agency of California in CA; Equitable Network Insurance Agency of Utah in UT; Equitable Network of Puerto Rico, Inc. in PR), and Equitable Distributors, LLC. Variable Products are co-distributed by Equitable Advisors, LLC (Member FINRA, SIPC) and Equitable Distributors, LLC.

When sold by New York-based (i.e. domiciled) Financial Professionals life insurance is issued by Equitable Financial Life Insurance Company (New York, NY).